The Changing UK Grocery Market

It is no secret that the UK grocery market has been undergoing a fundamental structural shift in recent years. While the size of the market as a whole has remained stable, the split of sales by channel has materially changed, and the trends are expected to continue. Core supermarket sales are down, replaced by growth in the online, convenience and discounter channels.

Total UK Grocery Retail Sales Share by Channel

|

Channel

|

2012

|

2013

|

2018

|

|

Hypermarkets and Superstores

|

44%

|

44%

|

39%

|

|

Small Supermarkets

|

21%

|

21%

|

18%

|

|

Convenience Stores

|

21%

|

21%

|

22%

|

|

Discounters

|

5%

|

6%

|

9%

|

|

Online

|

3%

|

4%

|

7%

|

|

Other Retailers

|

6%

|

5%

|

4%

|

**Source: IGD UK, data year to April including VAT and excluding fuel sales

The trends represent outcomes from changing patterns of consumer behaviour. Recession-hit, time-pressured consumers are becoming savvier in their search for value. High-street convenience stores allow them to control the size of their shopping baskets, while discounters offer attractive prices for commonly-shopped products. Online channels allow for simple price comparisons and also deliver on the ease of purchase dimension.

Seeing this shift, the largest UK grocery retailers have responded by trying to follow market trends –beginning with investing in their online platforms and expanding their convenience footprints.

Tesco and Sainsbury’s are leading the way in online, while Asda and Morrison’s have put significant resource behind their recently launched online platforms. On the convenience front, Tesco and Sainsbury’s are also driving the shift into smaller stores, although Morrison’s has been investing significantly since entering the channel in 2011 and Asda is trialling the format.

A Looming Price War with Discounters?

Despite significant investments into online and convenience, the top supermarkets are struggling financially. Market shares at the top grocers are down, and it is increasingly clear that the majority of the share loss is to the benefit of the discounter channel.

Tesco has been hit the hardest, with most recent financial year UK profits down 8.3%. Similarly, and for the same time period, Morrison’s underlying operating profit was down 7.5%, and Sainsbury’s profit before tax was down 1.4%.

The focus has now turned very quickly to responding to the rise of discounters and their promises of lower prices and higher price transparency, with Tesco, Morrison’s, Sainsbury’s, and Asda all committing to material investment in price reductions (£200m-£1bn), as well as an increasing attempt to “match” the “transparent” discounter net pricing model, which relies on Every Day Low Prices (EDLP) that are rarely promoted.

The recent announcements raise two very important questions for the UK Grocery landscape:

- What does this mean for UK grocery?

- What does this mean specifically for manufacturers of branded goods?

What Does This Mean For UK Grocery?

UK discounters employ EDLP models, under which products are sold at a lower base price point and rarely promoted. At Asda, Morrison’s, Sainsbury and Tesco, base prices are higher, and the average proportion of sales on promotion is 45%, while at Aldi base prices are lower, and only 3% of sales are on promotion, highlighting the material difference in models.

The big question is whether a reactive move towards a more “transparent” EDLP model consisting of lower shelf prices and reduced reliance on promotions will be good or bad for the manufacturer-retailer system.

The answer depends a lot on the dynamics of the category, and how consumers behave within it.

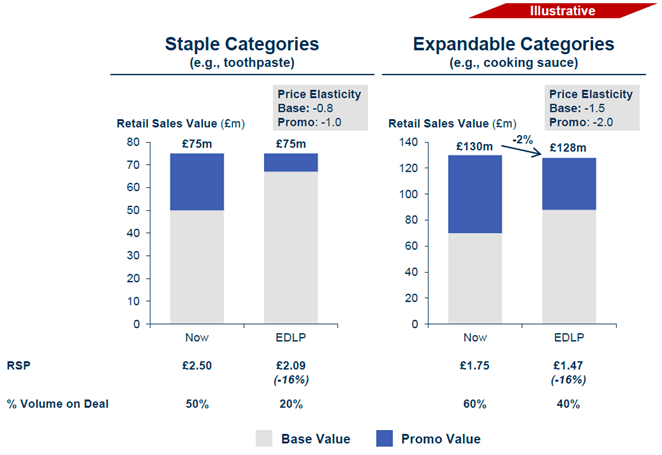

In the short-term, the key variable is the nature of the category and the key distinction is staple vs. expandable.

In staple categories (e.g., toilet paper, toothpaste, laundry detergent), consumers tend to purchase the same annual volume regardless of promotional mechanic, and promotional sensitivity is relatively low. As a result, the difference between price elasticity of demand on base price and on promoted price tends to be relatively small. Promotions may shift consumers around individual brands, but are unlikely to bring material numbers of new consumers into a category. In such situations, moving to a lower RSP / lower promotional reliance model across all branded providers within a category could actually preserve or even boost the profit pool available for sharing between manufacturers and retailers, because it essentially moves the same consumers from promoted price to more consistent full price purchase. Effectively, the increase in profit from the more consistent purchase at full price will outweigh any loss from fewer promotions. This boost does not account for any longer-term volume increases from consumers coming back to the supermarkets to shop for these categories due to reduced RSPs more in line with discounter prices.

In expandable categories (e.g., cooking sauces, beer, crisps, crackers), consumers tend to be much more sensitive to promotions and relatively less sensitive to changes in headline price, reflected in a typically greater difference between base and promoted price sensitivity. Promotions in these categories, which are often linked to prominent off-shelf end-of-aisle displays of the products, can temporarily bring in material numbers of new consumers and have a significant effect on volume and profitability. In such instances, a significant change in promotional strategy could, at least in the short-run, inadvertently shrink the profit pool. For example, someone who usually snacks on crisps once or twice a week may decrease consumption if crisps are not on promotion – even if the RSP is slightly lower than it is today – instead choosing other snacks or no snack at all. In this example, the gain from more consistent purchases at full (albeit reduced) price will not outweigh the loss from fewer promotions. Here, companies are essentially losing consumers to other categories. In the long-run, this may be mitigated somewhat if the reductions in RSP lead to share increases for supermarkets, but the short-term issue in these categories is acute and significant.

In summary, the move towards reduced and more transparent pricing is likely to be profit-neutral from a system perspective in the case of staple categories, but likely to be profit-eroding, at least in the short-run, in the case of expandable categories. The chart above demonstrates that for expandable categories a realistic result from the move to EDLP would be a decrease in RSV of 2%. While in percentage terms this may not seem very large, the resulting decline in the wider profit pool and manufacturer profits would be significant.

Clearly, the specifics will vary a lot across individual categories, and depend on a very broad range of variables (price sensitivity, promotional sensitivity, current volume sold on deal, etc.). Many categories will behave in a “hybrid” manner vs. the ends of the spectrum described above, and the optimal solution in their case may be more complicated to identify.

What Does This Mean Specifically for Manufacturers of Branded Goods?

If EDLP is adopted, manufacturers of expandable categories have cause for concern about the fall in volume from promotional reduction not being outweighed by the increase in volume from lower base prices. They also have real cause for concern if retailers decide that this short-term shortfall needs to be funded by an increase in retailer margins, which, in light of the often fractious relationships between the parties, is not an unlikely scenario.

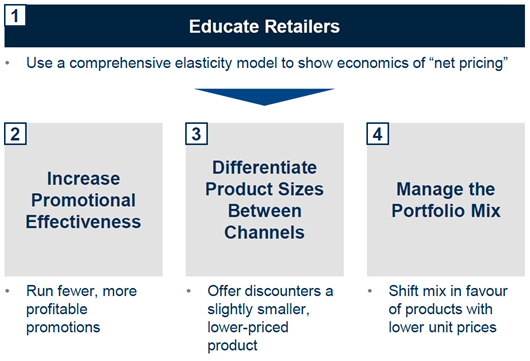

These companies will need to think of very creative solutions for mitigating supermarket concerns over discounters while maintaining profits. We see at least four options available:

The first option is to educate retailers on the true economics of net pricing in expandable categories. Assuming the categories in question behave in the way described above, the answer may be as straightforward as making the system economics transparent to the party across the table. Clearly, detailed information on consumer willingness to pay, consumer purchase behaviour, promotional effectiveness, and competitive dynamics will need to be pieced together in a compelling manner to enable the success of this approach.

A second possible route would be to run fewer, more profitable promotions to help retailers lower the average number of deals at any point in time and start to move closer to the discounter model without going all the way to EDLP. For many consumer products companies, this approach will actually improve promotional effectiveness, as the proportion of more visible, and generally more profitable, off-shelf promotions increases. This strategy also gives manufacturers the opportunity to reinvest savings from reduced trade spend in other activities where they may be able to achieve higher ROI, such as shopper marketing. Key to the success of this strategy is having a thorough understanding of historical promotional performance and consumer preferences for different promotional mechanics.

An alternative strategy for consumer products companies is to differentiate product sizes between channels, offering discounters a slightly smaller, lower-priced product, thus limiting consumers’

ability to cross-compare directly and ultimately benefiting large supermarket chains. Manufacturers in this scenario can still achieve a relatively

constant price per weight while producing different packaging sizes. Undoubtedly, this can increase manufacturing complexity and costs, so a balance must be reached. For this strategy, it will be critical to understand the importance consumers place on packaging size, the relative sizes of competitors’ products, and the cost implications of additional manufacturing complexity, in order to minimise potential volume losses and manage any financial downside.

Another possible method to assist retailers in reducing prices without eroding the system profit pool is to manage the portfolio mix in the supermarkets in favour of existing products with lower unit prices, lower volumes sold on deal, and lower depths of discount when on promotion. Smaller formats within an existing portfolio often fall into this category. For manufacturers, such products may even have more attractive margins relative to their larger, standard products. If the portfolio mix can be tailored to smaller formats, a move to an EDLP pricing model may actually be profit-neutral once again. As the likelihood of retailer acceptance of a change in mix would rely on the recent performance of these other products in the portfolio, a strong retailer story is vital.

Summary and Conclusion

The rise of the discounters has created significant pricing pressure on the traditional UK grocery chains. There is a pressing need for manufacturers and retailers to respond without inadvertently eroding their shared profit pool.

In the first instance, it will be vital to respond in a highly discriminating manner to the pressure to match the discounter model. The distinction between staple and expandable categories will be critical to keep in mind, at least in the short-term.

For manufacturers of expandable categories specifically, the imperative is to be pro-active in helping retailers manage and respond to this threat while ensuring their own profits do not suffer, through strategies such as running fewer, more profitable promotions, differentiating their offer between supermarkets and discounters, and managing their portfolio mix.