The principles and beliefs about the economics of hydrocarbon have changed

The levers affecting the macro energy environment are changing dramatically and as a result the principles and core belief the industry have used to govern decision-making and manage their portfolio have come under severe challenge.

Peak oil as a theory is more or less dead, not as an intellectual idea, but as a practical one as the abundant resource base is joined by technology’s corresponding advancement to accelerate recoverable resources discovery faster than they can be consumed.

The consequence of the above, at the macro level has caused a supply glut, even as demand for hydrocarbons continues to rise at an accelerated rate. While most industry economists believe we will see a “normalisation” by the end of 2017 (that is one year for production cuts to filter through, and one year for strategic inventories to run down), there is an emerging view that the new normal will be materially different from the old one.

As Big Oil (which at the moment looks increasingly small), digests the levers affecting this macro environment change, a curious realisation is increasingly becoming more transparent. The portfolios of assets have a wide distribution of risks, costs, cash flows, and return on capital; making the distinction between “good and bad barrels” stark. Indeed the statement that “all barrels are created equal” has never been further from the truth then it is today.

Of course this distinction between barrels has always existed, but with crude at $100+, its relevance was often hidden in the portfolio shaping and management discussion of the past which favoured reserves growth and production. This historic focus on barrels discovered has now dramatically shifted towards return on capital, return on risk, and cash generation.

A new strategic approach to portfolio design is required

The realities of the new environment have already settled into the industry and the resulting focus on cost cutting, cash flow and balance sheet management, and asset sales are well underway. Progress will be made, while necessary it is likely to be far from sufficient.

There is a growing realisation that the industry needs a new way to bring more deliberate and disciplined decision making to questions related to the portfolio. Why do we have the portfolio we have, and what is the next best alternative? As the industry shakes out, investors are rapidly re-evaluating the investment case across players.

As lower prices bite, companies such as Exxon, Shell, and BP have started to build an investor proposition around “delivering sustainable and predictable cash flows.” This model suggests equity investors are willing to trade capital appreciation for a more secure stream of cash flow – one might say “bond like”. Indeed, as normalised returns in the sector are closer to the cost of capital, the importance of volatility management and return on risk across the portfolio become more relevant metrics for the sophisticated investor, those associated with sovereign wealth, pension funds, and endowments.

Despite the stated intent, in our experience, O&G companies are not set up to deliver on this proposition. Built into the DNA of O&G companies is the quest for discovery, the ability to open new frontiers, and take risks on complex bets that offer the chance for outsized returns. Explorers & developers think fundamentally differently than “financial managers”.

Learnings from other industries …

In spite of the vast differences between the world of O&G and that of asset management, we asked ourselves if there were parallels and lessons to be learned by applying investment portfolio theory to O&G. By evaluating the investment, risk signatures, and returns of the O&G assets, leadership teams can optimise the shape of the portfolio far more dynamically than in the past. If the appetite for total risk from management and investors declined, management could pare back certain assets or reshape its view of acquisition and divestiture candidates in order to enhance the predictability of the company’s cash flow. Conversely, if more risk appetite existed than was being used, leadership could choose a path on the higher bounds of the risk-return continuum.

This asset management mind-set would allow for a better dialogue between the company centre and those directly responsible for the assets within the portfolio.

We recently implemented this idea and premise with several oil and gas companies and found it has been a powerful mechanism for materially upgrading the strategic dialogue inside O&G companies and for delivering more clarity to investors. This article shares the learning from our recent work.

Elements of the New Approach

The case for a new mind-set

Ingrained in the culture of upstream O&G is risk-taking and finding the next big thing, and in many instances, creating significant value from them. In this mind-set, success is defined by creating the most value or finding the most resources relative to peers.

But as the dialogue with investors changes and predictability of cash flow becomes a primary objective, the definition of success must change accordingly. The new “objective” becomes a need to increase the predictability of sustainable cash flow while allowing for sufficient upside. In other words, any type of value creation objective must come with a minimum “output constraint” on cash flow (similar to the addition of very low risk assets such as treasuries into a financial portfolio).

Adding predictability constraints requires a different mind-set to the conventional one of explorers, where success now becomes hitting cash flow targets consistently. Outperforming the competition is secondary. It requires a deeper discussion on the trade-offs between return on risk, affordability, and cash flow timing across a portfolio of assets, in addition to the usual assessments of whether each opportunity or project is desirable.

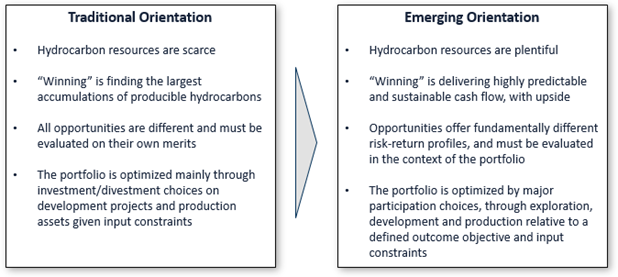

To put it another way, this approach requires executives responsible for shaping the upstream portfolio (including and arguably led by exploration departments) to think like absolute return fund managers. This requires a major mind-set adjustment in a world where the upstream has just begun to move away from a volume-based objective. Figure 1 illustrates the magnitude of mind-set change implied.

This new mind-set has major implications for resource allocation and performance management. As a result, it needs to take hold not only amongst the upstream management team, but also in the corporate planning process. The premise is that different portfolios, made of up different “asset types” will have different distributions and probabilities of outcomes depending on cash flow expectations and correlation of risk embedded in each combination.

So how can management teams practically apply this new mind-set to strategic decision making?

Determining the right portfolio “puzzle pieces”

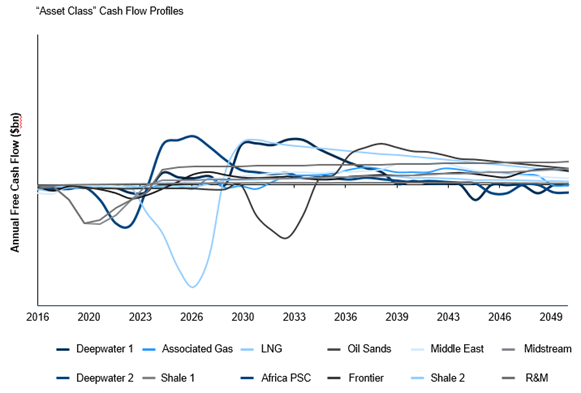

Strategic dialogues related to portfolio shapes in oil and gas companies tend to fall prey to the “clouds or weeds” problem. Either they are too “thematic” (“the clouds”), and therefore difficult to ground analytically e.g. “more liquids, less gas,” or too focused on one individual project (“the weeds”), and therefore lack a true portfolio perspective. In order to solve this problem, and create a set of analyses to test different portfolios, it is both possible and helpful to abstract from individual projects upwards to generic “asset classes” composed of economically similar projects. Such “asset classes” have economic signatures which are internally similar and consistent but externally distinct from others. Figure 2 shows an illustration of the cash flow profiles and returns of 10 “asset classes.” (The data have been modified to preserve confidentiality.)

Figure 2: Illustration of “asset classes” and their distinct economic signatures

Source: Marakon

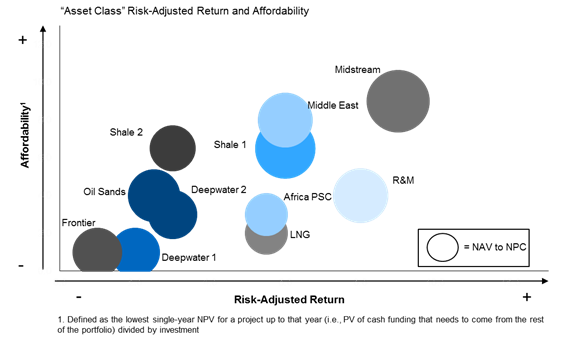

This methodology introduces a happy middle ground, based on a grounded analytical foundation that is nevertheless suitable for higher-level decisions around portfolio shape. It also provides the analytical inputs for the development of an asset-based portfolio model. Importantly each “puzzle piece” is assigned an economic profile against a range of affordability, value creation and risk measures that are derived from a database of internal and external project experiences. The impact and likelihood of risk can be quantified to provide a probabilistic view of each asset. As the foundation for an impactful forward-looking portfolio discussion, each puzzle piece can be ranked against a series of metrics to deepen executive understanding of sum-of-the parts performance against a specific objective function. This could be value creation per unit of investment, affordability, cash flow timing, or return on risk. Figure 3 demonstrates the ranking of different puzzle pieces against key metrics.

Figure 3: Ranking of illustrative puzzle pieces under different objectives

Source: Marakon

The number of puzzle pieces can vary depending on the client’s desired granularity and / or sophistication. Our analysis and experience suggests there are between 10 and 15 main puzzle pieces in the world today that exhibit substantially different economics and are suitable for portfolio design work at the strategic level. Building alignment across the executive teams (i.e. upstream, downstream, group planning and finance) on the right ones is critically important to arrive at a trusted set of economics for deeper and more valuable strategic dialogues. This alignment process is often underestimated. Establishing this fact base is a valuable process in its own right.

Understanding risk and maximizing true diversification benefits

Once the economic signatures for each puzzle piece are in place, a portfolio model can be created to simulate different outcomes associated with dialing-up or dialing-down concentration in any particular asset. However, even more depth is needed to ensure the issue of risk correlations is adequately addressed. Some risks (e.g. oil price) are broad, while others (e.g. geological) are narrower. The risk signatures of different puzzle pieces need to be deconstructed with two end goals—to quantify sources of risk common to all assets and sources of risk specific to individual assets. In doing this, managers can precisely quantify the benefits of different combinations of assets, and be more deliberate and precise about optimizing the level of diversification. The benefits of any diversification are maximized when risks are not correlated between puzzle pieces. For instance: 1) Price e.g. Brent vs. Henry Hub Gas; 2) Failure e.g. Gulf of Mexico vs. Oil Sands 3) Cost e.g. NA wages vs. international rig rates 4) Delay e.g. Deepwater rig delays vs. unconventional supply chain.

In addition to correlations across risks, there is also a need to look at correlations between them. For example, cost and delay risk are typically highly correlated. Any benefits depend on how sensitive different puzzle pieces are to individual risk types. For instance, diversification benefits are reduced between a portfolio of Gulf of Mexico assets and NA Heavy as both share a high sensitivity to oil price, despite differences in below ground risk.

Developing a portfolio simulation model

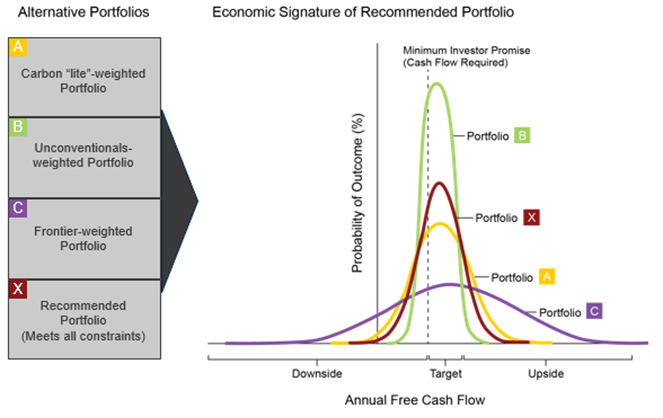

Optimizing a portfolio to a set of “outcome” objectives is based on the premise that there is an optimal level of diversification for the future portfolio based on the agreed objective function. If the inputs are “unconstrained,” achieving the desired outcome is that much easier. The challenge, of course, is that inputs are always constrained, be it by capital, resource availability, or technology. By understanding the desired output constraint, for example 85% probability of maintaining a certain level of cash flows into the future, in combination with a defined set of input constraints (exploration capex, development capital, resource availability); a simulation model can be created to provide insight about which portfolio shape is best for any given company. This simulation model can then provide input into the complex choices and trade-offs associated with managing the long-term portfolio shape. Figure 4 illustrates how such a simulation model has been used to create five alternative portfolios, each optimized around a different metric, such as IRR, NPV, return on risk, affordability, and carbon exposure. These metrics are then used as an input to the strategic dialogue on participation choices.

Fig. 4: Portfolio outcomes and shape

Upgrading the dialogue process

While this methodology is grounded in deep analytics and delivers precise direction on an “optimal” asset portfolio under different scenarios, the real benefit arises from its impact on the quality of strategic dialogues in the O&G world.

We have worked with many clients to deploy this approach and have observed that the process creates more insights and upgrades the nature of internal debate and dialogue. Each step in the process, be it alignment on the objective, insight on the cash flow patterns of different puzzle pieces and their economic signatures, or a discussion on risk correlation, alone led to a materially higher quality of executive discussions.

Through using this approach, we have observed that O&G management can make earlier and more decisive value-based portfolio decisions that have a material effect on the exploration budget and business development priorities. The approach also provides a “bridge” between the corporate objectives to meet changing shareholder demands and manage cash flow, and the upstream management teams’ goal to find and develop resources. This provides a critical mechanism for aligning around the company strategy and decisions on resource plays.

Summary and Learnings from Applying the Approach

This new approach has proved to be a powerful way of adding value to the strategic dialogue on managing the O&G portfolio. It is comprised of five key ingredients: 1) alignment on the objective function (i.e. the targeted outcome); 2) creation of “asset types” or puzzle pieces based on a set of internal and external experiences with different projects; 3) an understanding of how risks are correlated between different puzzle pieces, and across the portfolio; 4) the development of a simulation model to model different portfolios and their outcomes; 5) and a dialogue process around the approach, the interim outputs, and the portfolio shape decisions.

Finally, if Big Oil is to keep pace with changing market dynamics and new investor demands, then additional capabilities, analytical tools, and processes must be added and integrated into the existing decision-making models.