Gaining Strategic Advantage through Organizational Design

One of the biggest challenges facing modern corporations is ensuring that business strategy and organizational design are tightly aligned. Conventional wisdom suggests that it is critically important to decide the enterprise strategy first and then re-align the organization to deliver on it. Reality is quite different.

Structure defines organizational boundaries for where and how value is managed and delivered. It not only dictates accountabilities and responsibilities, but, by definition, structure provides the units by which a company’s financial and human resources are allocated. Therefore, structure is one of the key levers that chief executives can use to successfully manage the value of their businesses and best gain or leverage their competitive advantage.

Value exemplars often use organizational design to gain strategic advantages and help deliver consistent, superior returns to shareholders. For these companies, structure does not follow strategy — structure is strategy.

The following case studies demonstrate how structure and strategy are inextricably intertwined. The lesson to be learned in these examples is that there should be no such a thing as “an industry standard” organizational design because adhering to any standard structure may mean missing a hidden source of competitive advantage. A distinctive design can give your business a unique edge in the marketplace.

Flexible Structures Produce Flexible Strategies

Companies that organize around functions tend to develop functional and fixed strategies. Likewise, companies that organize around geographies tend to develop fixed geographic strategies. Beyond the lack of flexibility, both are easy to copy by competitors and will likely prevent the execution of distinctive strategies and performance in the long run.

One of the world’s best performing natural resources companies created a unique organizational structure that combines the advantages of small business units and “virtual structure” — groupings of small business units that can address different strategic issues and competitive environments.

Each of the 100-plus business units includes a small team with accountability for strategy, resources, and performance. This enables the CEO and his management team to push accountability for value as close as possible to the “coalface”, where value is actually created or destroyed. Moreover, there are no layers between these business units and the CEO and his team. The result: clear lines of sight for all managers.

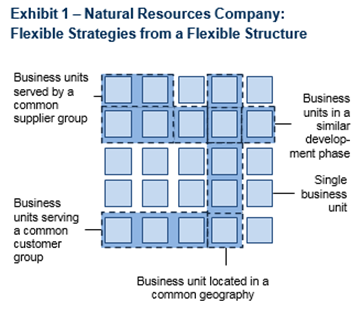

Some of these business units are also grouped in a virtual structure. Some groupings share collective accountability for managing the value of the company’s relationship with a global customer group. Other groupings have a similar collective accountability for a global supplier group or a strategy in a common geography (see Exhibit 1).

These virtual business units are able to tackle corporate strategic issues that the operational business units couldn’t address on their own without creating new layers of bureaucracy that too often become permanent. Moreover, because they are virtual, these larger groupings of business units can be reorganized in many different ways, as often as needed, to meet the company’s changing priorities as they evolve. This gives the company enormous capacity to respond effectively to an ever-moving agenda and competitive environment.

This flexible structure leads to better strategies. For example, by organizing four of its business units into a virtual unit operating in a common region, the company was able to identify and capture $800 million of value creation. Their unique structure provided a better understanding of how the region’s transportation economics could be dramatically improved by taking an enterprise- wide point of view across all operating units in the region. The competition could not see these opportunities because their organizational structures were defined by line of business, not region.

Innovative Global/Local Structures Provide Clearer Decision Rights and Better Strategies

Multinational organizations face strategic issues that are specific to particular local markets as well as those that affect many local markets at once. If you organize around global lines of business, you miss the former. If you organize around local markets, you miss the latter. If you organize around both, you create a matrix where dual responsibilities and reporting lines all too frequently result in a situation where no one is truly accountable for the value of anything.

A leading business school, with multiple campuses worldwide, wanted to build on its strategy to be the global leader in business education. To deliver on its ambitious strategy, the school had identified a number of issues the organizational model should address. First, it required a more effective regional leadership model to translate its multiregional presence into stronger connections with business and academic communities and greater success in fundraising and executive education. Second, the new structure had to address an increasing tension between the business model (reliant on executive education) and the talent model (focused on academic excellence and research). The school addressed the challenges by creating both global program directors and local market representatives where the local chairs would have primarily external responsibilities, such as building connectivity and relevance with the local community. Local chairs would also function as “the glue in the matrix,” providing input into strategy, fundraising, executive education, and academic affairs. To ensure successful strategy development and execution, both globally and locally, it was essential to clearly define decision rights. The organization used the principles behind the RACI framework (Responsible, Accountable, Consulted, and Informed) to ensure clarity of the local responsibilities and accountabilities while maintaining the global linkages through consultation and information flow around key activities and decision points.

What makes this business school’s solution distinctive is not so much that it took a particular structural approach to designing the matrix. The school successfully assigned well-defined accountabilities and responsibilities for managing the matrix as a whole along different dimensions aligned with its strategic objectives. This ability to manage the matrix and address the global/local tension is critical to delivering the strategy itself. Their approach also greatly helped define the required capabilities for key leadership positions, thereby better aligning the business and talent model.

The Matrix Becomes Manageable Using Global Standards with Local Adaptability

The global/local challenge is relevant to many companies. And virtually every company has a matrix, whether it chooses to organize that way or not.

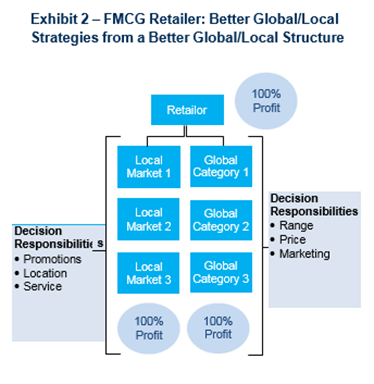

One of the world’s most profitable retailers addressed their global/local challenge by creating both global category and local market business units. While each business unit is accountable for its end-to-end value creation, it is also assigned specific “decision responsibilities” related to the levers it alone can pull to maximize end-to-end value of the overall business (see Exhibit 2).

The result is dramatically improved global and local strategies because each business unit can respond much faster to both local market and global category issues. For example, a price- based competitor in one local market was countered by selectively shifting certain key levers of pricing to local management. Strategic thrusts became more sophisticated as the company combined global category and local market intelligence. For example, a new premium range was launched only in prime central city sites instead of nationwide.

Instead of focusing on revenues and costs they alone can control, business unit management teams now focus on how to drive the end-to-end economics of the total business. This encourages a high level of global/local coordination without the need for coordinating bureaucracy. This focus also tempers line managers’ common concerns about performance shortfalls arising in areas outside their control.

When Value Drivers Dictate Interdependent Structure, Process Can Fill the Blind Spot

Value centers are often designed around the idea of independence where units have distinct strategies, customers, offerings, and economics. Cost centers are often designed around the idea of dependence where units exist only to serve the value centers. When there is inter-dependence between business units, the solutions are less clear.

A leading UK insurance company was struggling to address the inherent inter-dependency between its back book of pension policies and customers and its forward book of new products and customers. At first glance, the back book and forward book would seem highly connected. After all, the entire back book is simply customers the firm acquired in years past and the front book is just new customers being acquired today. However, as regulations adjust over time and create changes in product offerings, bulk customer acquisitions are made, and new systems are implemented then the company ends up with two very different businesses. The back book business is focused on managing legacy business through cost management, persistency, and buying closed books.

Meanwhile, the front book business is focused on recruiting and managing new customers through innovation, product design, marketing, CRM, pricing, and distribution. And even though these two “businesses” have very different value drivers, they share core inter-dependencies. For example, the customers in the back book are in fact one of the core sources of value for the front book as the back book pensions roll over into a set of de- accumulation products — a main focus for the front book business. On one hand, keeping the business combined in a single operating unit risks asking one set of managers to run two very different businesses and thus lose the strategic focus of pure play competitors. On the other hand, separating the businesses risks leaving significant value on the table — as the back book customers leave the franchise at the point of rollover.

Exhibit 3 – Financial Services Company: Better Structure Making Better Strategies Happen

The insurance company was able to achieve both independence and dependence by letting the value driver dictate structure and establish a clear process and set of tools to fill the blind spot. Two separate units were created with their own set of objectives, targets, and skills aligned with the value drivers of the underlying business yet the embedded common customer base was freely accessible to the front book through a process bridge. Incentives were put in place whereby the front business got access to the back book customer base at a heavy discount to the true market price for customer acquisition, while the back book business received a “fee” for each customer that was converted into a new front book customer. Internally the costs and revenue were a zero sum, but the franchise received the benefit of maintaining a very high rate of internal vestings and was able to use structure as a means to gain a heightened degree of strategic focus — by organizing its “inter-dependent” businesses to maintain a sharper focus on the value drivers embedded in its franchise. The new structure enabled a fundamental shift in strategy for each of the two units.

Better Structures Make Better Strategies Happen

In practical terms, strategy emerges and evolves as a consequence of the hundreds of decisions managers make every day. Since structure critically influences the way managers view their competitive environment, it inevitably affects their decisions, and, in turn, influences their emergent strategies.

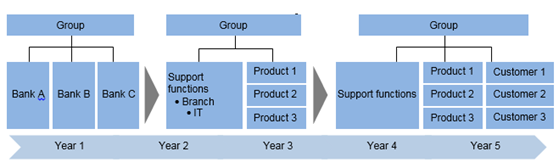

Take the case of the CEO of a leading financial services company who restructured his organization every 18 months over a period of five years and achieved a 30% annual total shareholder return.

The ability to rapidly create new structures turns out to be a competitive advantage — enabling organizational focus on the right issues at the right time across customers, products, and channels. This ability to renew and evolve strategic focus through organizational design keeps the management teams focused, invigorated, and consistently ahead of the competition. Structure has become a way for the chief executive to focus the organization on key business issues and allow his leaders to develop strategies to address these issues. To achieve this, a senior executive is made profit-accountable for each business issue. These executives are charged with delivering substantial performance enhancement from resolving the issue. A supporting business unit is then created to ensure that the strategy is effectively executed.

The organization evolves in harmony with the developing agenda (see Exhibit 3). As soon as one issue is resolved, another emerges and the company’s structure transforms to reflect the new set of priorities. As the financial services company’s priorities changed from merging multiple banks to cost reduction to customer profitability, so did the organization’s structure.

Better Structures Produce Better Managers

There are two extremes when answering the “people question” while building an organization. The first is to “organize the staff” — designing the organization to suit the talent you have. The other is to “staff the organization” — finding the best people to address the key challenges facing the organization.

In reality, the answer is to do both. Organize yourself to develop the talent you need to compete in the markets you serve. If you want to develop more managers who can manage for value, create a lot of opportunities for them to do so. Managers with unique talents for discovering and developing new customer groups — or creating and executing new strategies — don’t happen by chance. They emerge when there’s an organizational structure in place that allows them — and challenges them — to refine and perfect their craft.

Structure Is Strategy

Every business should be organized to exploit what’s unique about its markets, products, and people. If your structure is similar to your competitors’, your ability to develop distinctive strategies is almost inevitably blunted. Distinctive strategies require distinctive structure.

You will know that your structure is distinctive when it consistently allows you to outclass your competitors at uncovering strategic insights, when it effortlessly manages both the global and local dimensions of your business, when your organization quickly adjusts its focus to the right strategic issue at the right time, and, most importantly, when the CEO can say that his or her management team is working at the peak of its game. Then you’ll know your distinct structure is your winning strategy.

* Re-edited and updated from original Marakon Commentary © Marakon 1999