What B2B companies can learn from consumer companies on driving ‘smart growth’

The Case for Change: Early adopters will have a first mover advantage

Intensifying competition and more customer purchasing sophistication is making it increasingly hard to sustain a differentiation advantage over competitors. Good products or solutions combined with regular offer enhancements is no longer the recipe for winning and retaining customers. Unlocking growth and creating customer ‘stickiness’ requires a grounded point of view on who you are going to serve (and who not to target), how much those customers are worth, and what offer will deliver more quantifiable value to your customers than your competitors. Unless B2B companies start adopting some of the proven approaches employed by consumer companies and move beyond mere lip service to being customer-centric, many risk an eroding competitive position and deteriorating economics.

Lessons from B2C companies

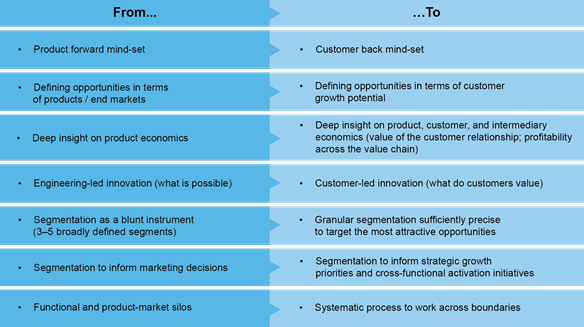

Many B2B companies tend to work product forward. That is to say, they start with products or solutions they have (or could have) and end markets they serve (or want to serve), to set growth priorities and improvement plans.

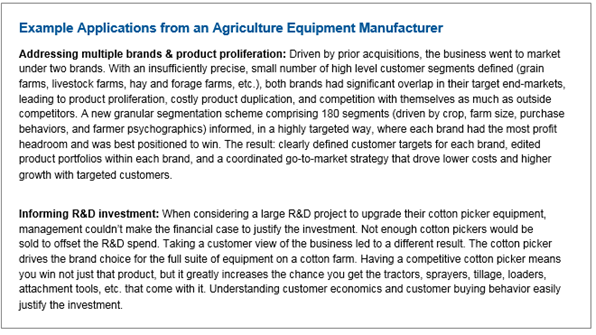

Leading consumer companies, and increasingly banks, technology firms, healthcare providers, and even some industrial products & services businesses, are achieving higher levels of growth at better margins by reorienting their thinking to be customer back. They start by precisely defining highly granular segments (i.e. dozens of segments) and then select their bull’s-eye customer segments they aim to win, and create an offer and go-to-market model to profitably serve target customers.

Key Enablers Observed in B2C Companies:

- Put the customer at the center of all decisions about the business model (e.g. R&D investments, operating configuration, sales channels), not just marketing choices

- Get orders of magnitude more granular with how customers are segmented, driven by differences in customer behaviors + attitudes + demographics + economics

- Link up commercial and financial insights (customer demand drivers and customer economics)

- Eliminate silos due to traditional functional and product-market boundaries

Getting More Customer Centric: Where to Start

Applying best practices from B2C need not be disruptive or take an extended period of time. A few new capabilities can uncover a large number of performance improvement opportunities. In our experience, moving the needle on growth and margins starts with adding two customer-centric capabilities to the toolkit:

- Provide a line of sight into your fully-loaded customer economics, by which we mean the current and potential value of the customer relationship, inclusive of everything you sell to them (or could sell to them) and understand drivers of profitability including price, product mix, and cost to serve.

- Create and leverage a granular customer segmentation, moving beyond observable characteristics (e.g. size, industry, sub-sector) and identify and prioritize segments based on differences in observables + behaviors + needs + economics. By granular, think dozens of segments, not single digits

Used in tandem, these two tools alone identify rich veins of opportunity for revenue and margin growth, and help build consensus for action across organizational boundaries to realize those opportunities.

Benefits: What B2B Companies Stand to Gain from Building These Capabilities

- Fresh set of actionable opportunities to energize the organic growth agenda

- Increased customer ‘stickiness,’ making share more defensible

- Advancement of non-technological differentiation to complement the innovation pipeline

- Better concentration to focus the often scarce resources available to enable organic growth, e.g., R&D investments, channel enablement, customer support and service, etc.

Several B2B companies are well on the path to being more customer-centric, putting laggards at a competitive disadvantage over time. The good news is that getting to actions and tangible impact can take as little as 3–4 months.

Summary

If you can answer ‘yes’ to some or many of these questions, you might be a good candidate for building the customer-centric capabilities discussed above into your tool kit:

- Does your organization talk about being customer-centric but lack a well understood repeatable model for creating and using customer insight to inform decision-making?

- Do you rely heavily on acquisitions to meet your growth ambitions and struggle to drive organic growth that outpaces the market?

- Do you suffer from product or feature proliferation that goes beyond what customers value and are willing to pay for?

- Are you losing customers to competitors because they are better at meeting their most important needs?

- Do you rely on price as the primary lever for retaining customers?