As available to Financier Worldwide.com subscribers

Introduction

You cannot manage something you cannot measure, and at the heart of the very best organizations—those that consistently outperform competitors—is an almost obsessive focus on driving growth in Economic Profit (EP). This commentary recaps a discussion Marakon started almost 35 years ago when it pioneered this simple but powerful metric and linked it to a new strategic framework for managing the value of an enterprise.

Winning company strategies must ultimately be about delivering outstanding financial performance over time. Our experience, however, points out that much of the business strategy today surprisingly lacks an explicit economic foundation.

Most well-run companies obviously focus on delighting their customers and serving them in the best way possible. As a result, they often improve customer satisfaction, increase their market share and even achieve higher margins by raising prices. But there are many ways for companies to achieve these objectives and not all of them necessarily drive superior shareholder value creation over time. Truly great strategies manage to deliver both superior customer as well as company value over time.

Delivering strong Economic Profit over time is equivalent to increasing company value and plays a critical role in developing and understanding winning strategies.

A reminder of what Economic Profit is, its uses and advantages

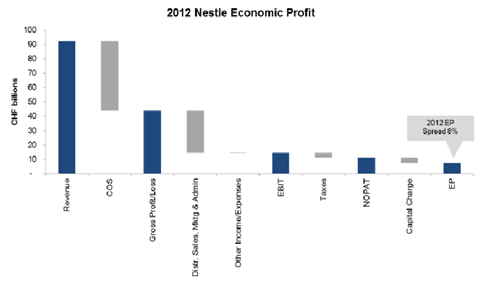

Economic Profit is a simple concept defined as after-tax earnings (NOPAT) less a charge for equity capital, or equivalently, invested equity capital times the difference between return on equity (RoE) and the cost of equity (Ke), as illustrated below.

As a metric, Economic Profit has important advantages over most other metrics commonly used to set managers’ objectives. Economic Profit is unique in its combination of 1) an income statement measure, 2) a related balance sheet measure, and 3) an external capital markets measure. As such, EP has a signaling function that is superior to any other financial metric. In a single period, it provides line of sight into how much value a strategy is creating, while over multiple periods it provides an accurate view of overall value creation of such strategy. It also facilitates an objective evaluation of strategic alternatives as part of a multi-year valuation.

In addition, using Economic Profit is simple and it can be applied at all levels of the organization (e.g., at the BU, PMC, customer or brand level), allowing you to assess how different parts of your portfolio are contributing to value creation. It is absolutely the best proxy we have in our possession that links product-market performance and financial or capital market performance.

Finally, one major advantage of EP in our experience is that it makes it possible to consistently join-up strategic, capital allocation and operating decisions.

The rationality of it …

Events over the last 20 years, and especially during the economic crisis, have led some to believe that the stock market behaves inconsistently and often irrationally. Managers must believe that capital markets price equities rationally and that there is a clear link between investment decisions they make and the market value of the company’s common stock over time. If this is not the case, they will claim that equity valuation is arbitrary and capricious, and they will be unwilling to link their strategic decisions to concrete considerations of value impact; indeed, many managers are of this view today. This skepticism fuels the agency problem, making it less likely managerial decisions will maximize the company value.

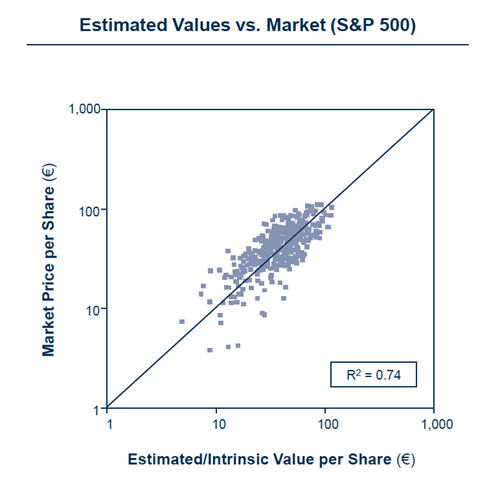

Despite managerial skepticism, there is strong evidence that on average, over time, equity prices are determined by investors’ expected future equity cash flows and the cost of capital. We have been able to empirically demonstrate time and again that stock market valuations correctly reflect the economic fundamentals of businesses and that sentiment-related fluctuations are usually short-lived unless grounded on longer-term fundamentals. In other words, all evidence is that stock markets are indeed efficient. This is where Economic Profit fits in.

Empirically, the correlations between Economic Profit Growth and value creation of an enterprise is 100% and in turn, over time the correlation between value creation and total shareholder returns has been shown to be stronger than any other metric.

Contrasting the above correlation vs. other measures (Historical EPS R2 = 0.45, Historical ROA R2 = 0.24, Historical P/E multiple R2 = 0.16), one can clearly see that EP is by far a better predictor of the value creation potential of a company.

Therefore, while it is almost impossible for CEOs and their leadership teams to manage a company’s share price, they can and should have a big influence on the size and growth of Economic Profit.

Are you winning? What EP tells us about your strategy

In a recent discussion with a client, we argued that “you should only participate in businesses in which you can sustainably win over time.” This raises the seemingly simple question of what we actually mean by “winning.” Is it about gaining market share, adding new clients, expanding in emerging markets, or something else? What is the best objective and indisputable measure for assessing performance?

Using Economic Profit provides for an accurate answer. First, the minimum performance threshold for any strategy is to consistently deliver EP>0 over time (i.e., value creating). A “winning” strategy (at the company, BU or segment level), however, should be one that delivers superior EP growth vs. competition over time. Taking this one step further, the best strategy is always one that meets the above two criteria but at the same time maximizes EP growth.

It should be clear from the above that we do not believe in generically defined “balanced” objectives over time, unless they combine in such a way as to consistently grow Economic Profit over time. While every single company aims at increasing customer satisfaction and share and improving efficiency and cost position, such strategies are not necessarily differentiating nor value-creating. A company that has an obsessive focus on growing Economic Profit is likely to make strategic choices that will create competitive advantage over time. On the other hand, broadly focusing on “competitive advantage” will not per se deliver high EP growth and therefore superior shareholder value over time.

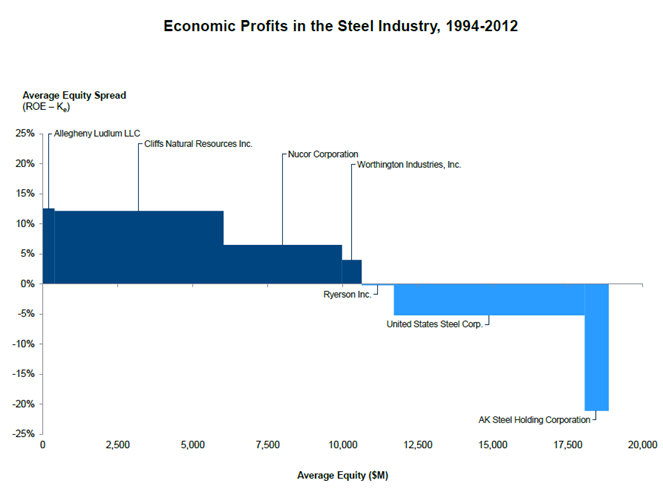

Take for example this analysis on the steel industry. We have looked at the economic profitability of the US steel industry over the period 1994-2012. As you can clearly see from the illustration below, there have been substantial differences in economic profit generation between major players, with companies such as Cliffs Natural Resources creating substantial value while the US Steel Corporation consistently generating profitability below its cost of equity.

Overcoming common challenges in using EP

Based on our experience, institutionalizing EP is rather simple. Contrary to popular belief, EP is a much simpler measure vs. other measures such as EVA or CFROI, both of which require multiple accounting adjustments and are a lot more complicated to calculate.

There are nevertheless a few common issues that you need to pay attention to:

- The balance sheet may not be visible to the business unit but businesses are nevertheless accountable for their use of capital. We often hear that “we have no visibility on the balance sheet.” However, all strategic choices that a business makes have direct implications for how capital is deployed and company capital allocation rules need to reflect this in simple and transparent ways (e.g., market-based transfer pricing rules).

- Keep the cost of equity capital estimates simple: Academic literature is littered with ideas on how to best estimate WACC. While it is important to properly reflect the impact of capital use and risk profile on company value creation, it is equally important to keep in mind that the choice of the best available strategy to a business is mostly independent of the precision with which the cost of capital is calculated.

- Keep the management accounting simple: It is important to remember that value-creation is based on the expectation of future Economic Profit growth. While accounting rules may sometimes require adjustments to the balance sheet that do not flow through to the income statement (e.g., goodwill write-offs), such adjustments do not affect business forecasts.

Summary

Economic Profit is unique in that it combines an income statement measure, a balance sheet measure and a capital market measure all in one number. Choosing strategies that maximize EP over time will practically always maximize company value. EP is easy to understand and apply and it provides for a powerful linkage between strategy choices and financial performance.